Apart from the limited times that a gift inter vivos policy will meet all the client’s needs, there is another problem with them, which is simply that there aren’t many companies offering them. This means that they are sometimes not as cost effective as they could be. But there is an alternative. Instead of the gift inter vivos policy, somebody could consider building a multi-cover plan, made up of a group of 5 level term assurance covers. These 5 covers run alongside each other with terms of 3, 4, 5, 6, & 7 years respectively. Each cover should be set at one fifth of the liability.

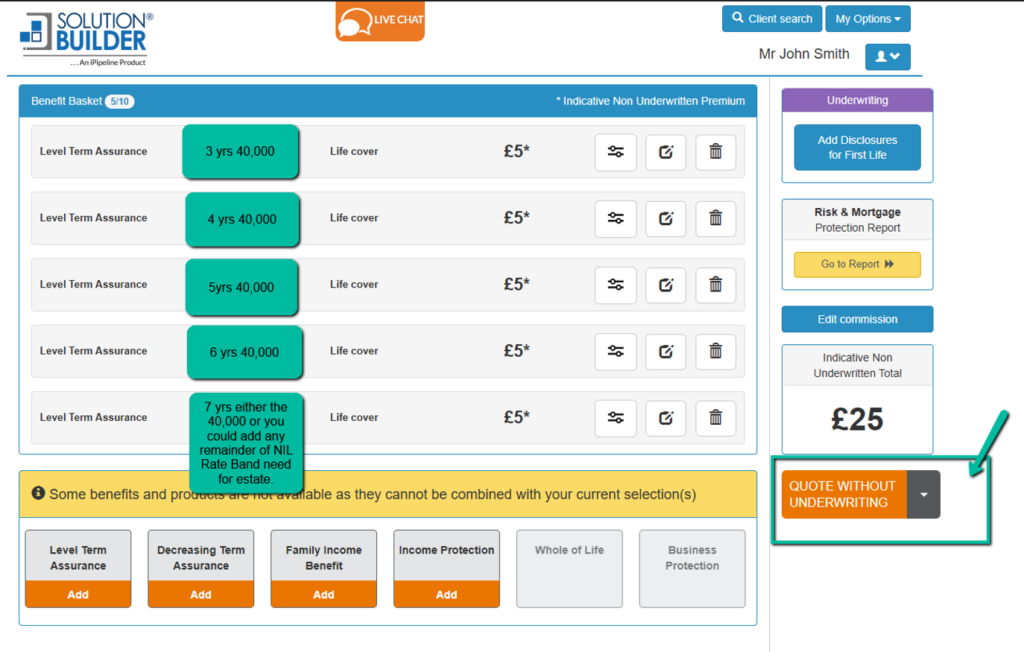

Using SolutionBuilder for Multiple Level Term Policies

Within SolutionBuilder, you can add five level term policies that run alongside each other for durations of 3, 4, 5, 6, and 7 years. This approach is often used for Inheritance Tax (IHT) planning, particularly when dealing with Potentially Exempt Transfers (PETs).

Example Scenario

- PET Value: £825,000

- Nil Rate Band (NRB): £325,000

- IHT liability in first 3 years: £200,000

Each cover should be set at one-fifth of the liability.

For example:

- If the liability is £200,000 in the first 3 years, then each policy should cover £40,000.

Key Consideration

Using this strategy consumes the client’s Nil Rate Band, meaning the remainder of the estate may not benefit from the NRB. For instance, you could add £125,000 to cover this in the 7-year benefit.

It’s strongly recommended that whichever policy option is selected it should be placed into trust. This will ensure that the benefits from a claim on the policy are not added into the individual’s estate, which would increase the liability, somewhat defeating the purpose. It also means the policy does not get caught up in probate so can be paid to the beneficiaries quickly to pay the liability as soon as possible.